The First Step: Getting Pre-Approved for a Mortgage [INFOGRAPHIC]

Some Highlights

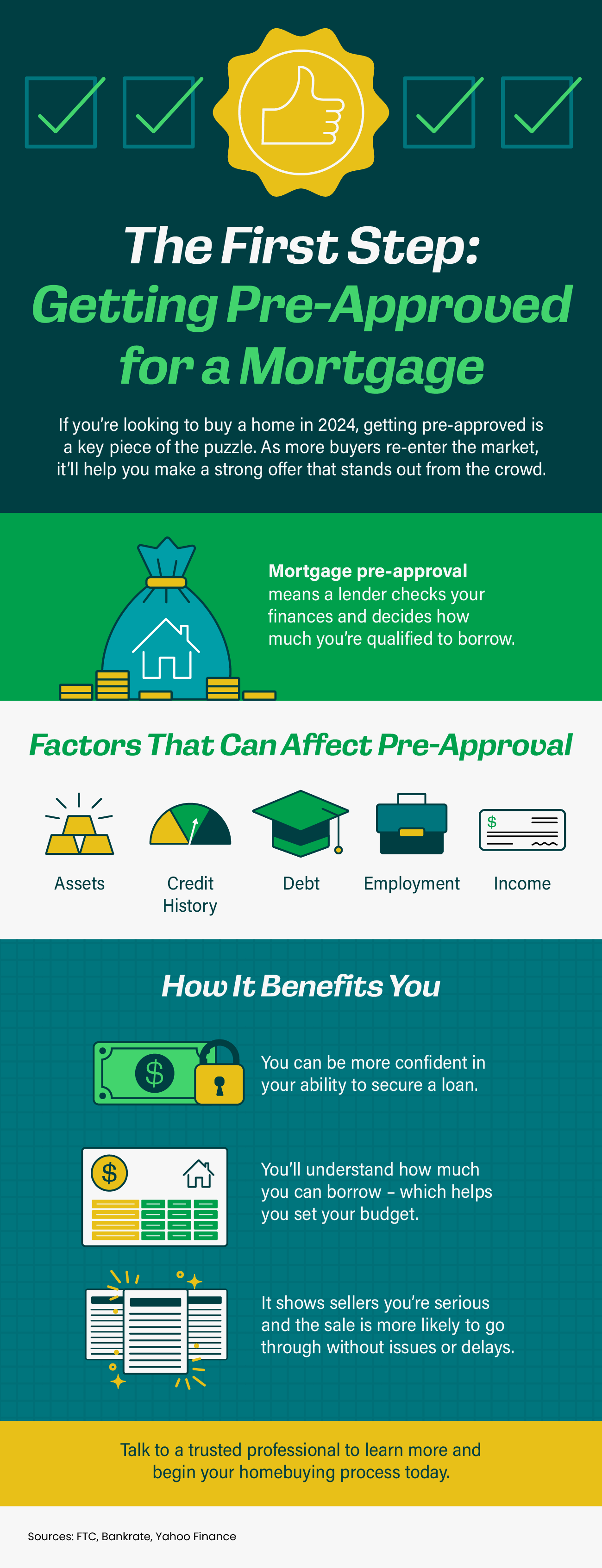

- If you’re looking to buy a home in 2024, getting pre-approved is a key piece of the puzzle. Mortgage pre-approval means a lender checks your finances and decides how much you’re qualified to borrow.

- As more buyers re-enter the market, it’ll help you make a strong offer that stands out from the crowd.

- Talk to a trusted professional to learn more and begin your homebuying process today.

Categories

- All Blogs (406)

- Buying Myths (86)

- Demographic (16)

- Distressed Properties (2)

- Down Payments (5)

- Equity (1)

- First Time Home Buyers (114)

- Foreclosures (17)

- FSBO (10)

- Home Buying (266)

- Home Selling (203)

- Infographics (80)

- Interest Rates (55)

- Inventory (3)

- Investing (4)

- Move-Up Buyers (66)

- Pricing (74)

- Real Estate Market (209)

- Rent vs Buy (24)

- Resource (6)

- Selling Myths (73)

- Senior Market (2)

- Video (5)

Recent Posts

The Big Difference Between Renter and Homeowner Net Worth

Renting vs. Buying: The Net Worth Gap You Need To See

Avoid These Top Homebuyer Mistakes in Today’s Market

The Benefits of Using Your Equity To Make a Bigger Down Payment

How Much Does It Cost To Sell My House?

Two Reasons Why the Housing Market Won’t Crash

The Top 3 Reasons Affordability Is Improving

Home Values Rise Even as Median Prices Fall

Don’t Fall for These Real Estate Agent Myths

Why Buying Now May Be Worth It in the Long Run

GET MORE INFORMATION